The US Money White Strategy

By: Chuck Hughes

The following is an excerpt from Chuck Hughes' Ultra-Safe Money Strategies

I would like to introduce you to the US Money White Strategy, which is one of the most profitable and low-risk income strategies I have encountered in my investing career. The White Strategy produced consistent returns during the financial crisis and the severe 2008 – 2009 bear markets. And it produced consistent returns during times of volatile, non-trending markets.

Many investors are not familiar with the concept of selling option premium to generate cash income. Selling option premium is a very simple but lucrative income strategy.

When you sell option premium, you can get paid up to a 20% to 30% cash payment up front when the option is sold. You get to keep this cash payment regardless of the price movement of the underlying stock.

Selling option premium to generate immediate cash income is the ideal strategy for volatile markets and an uncertain economy. We will look at an actual trade example below that allowed me to purchase Morgan Stanley stock at a 30% discount to its current price at that time.

When you buy stock at a 30% discount you can profit if the stock price increases, remains flat or even declines 20% to 25% resulting in a much higher probability that the trade will be profitable. This gives the option income strategy a huge advantage over a stock purchase strategy and allows you to profit in any type of market condition.

The option income strategy works just as well with bearish trades, which allow you to profit in bear markets when stocks and ETFs are declining in price. Bearish income trades not only reduce portfolio risk but can dramatically increase profit opportunities and provide a whole new dimension to income investing.

Due to the versatility of the option income strategy and its ability to profit in up, down, or flat markets, I was able to generate option premium income during severe bear and volatile markets. Over a 5 year period I collected $7,485,348.68 in gross option premium. This averages out to more than $124,000 in cash income per month! I have been trading the option income strategy for many years. During the 1990s I generated over 11 million dollars of gross option income.

The key to selling option premium to generate cash income is to make sure the option you sell is ‘covered’. There are two ways to implement the option income strategy with limited risk:

Bullish Covered Call Trades

- Buy 100 shares of a stock and sell a related call option also known as a ‘buy write’ or

- Purchase a call option and sell a call option with a higher strike price to create an option debit spread

Bearish Covered Call Trades

- Purchase 100 shares of a bearish ETF and sell a related call option also known as a ‘buy write’ or

- Purchase a put option and sell a put option with a lower strike price to create an option debit spread

For bullish trades the short option is ‘covered’ by owning the stock or owning a call option. And for bearish trades the short option is ‘covered’ by owning the bearish ETF or owning a put option.

Because the short option is ‘covered’, this is a limited risk strategy and you can’t lose more money than you invest. Selling ‘covered’ option premium incurs considerably less risk than investing in stocks. Selling option premium enables me to profit if the market goes up, down, or remains flat, and has given me the edge in producing consistent returns during any type of market condition.

Now let’s look at an example of the first type of Covered Call trade that is initiated by purchasing stock and selling a related call option. This is also known as a ‘buy write’ trade. I bought 600 shares of Morgan Stanley stock at 24.22 and sold to open 6 Morgan Stanley July 20-Strike call options at 7.27. These options expire in 4 months.

Selling to open the 20-strike call option at 7.27 points resulted in $727 in cash per contract being credit to my brokerage account; or a total of $4,339 (after commissions) for 6 contracts. Purchasing the stock at 24.22 points and receiving 7.27 points in cash resulted in a 30% cash payment I received up front on the day I initiated the trade. I get to keep this 30% cash payment regardless of the price movement of Morgan Stanley stock.

Buy Stock at 24.22 Points and Sell Option at 7.27 Points

Equals 30% Cash Dividend Over a Four Month Period

7.27 Dividend by 24.22 = 30%

When this option expires in 4 months I can sell another option and collect another cash payment. This is called a ‘rollover’. If I rollover this option a second time I would receive a total of 3 cash payments over the course of one year. This has the potential of producing up to a 90% cash payment over the course of one year which could almost pay for the initial cost of the stock and dramatically lower risk.

Up to 90% Cash Dividend Potential

Over the Course of One Year by ‘Rolling Over’ Option

Buying Morgan Stanley stock at a 30% discount reduces risk considerably. This trade will profit if Morgan Stanley stock increases, remains flat or even declines 20% to 25% resulting in a much higher probability that the trade will be profitable.

This can result in a high percentage of winning trades even if your market timing is not very accurate. This gives the covered call strategy a big advantage over a stock purchase strategy which requires a stock price increase to be profitable.

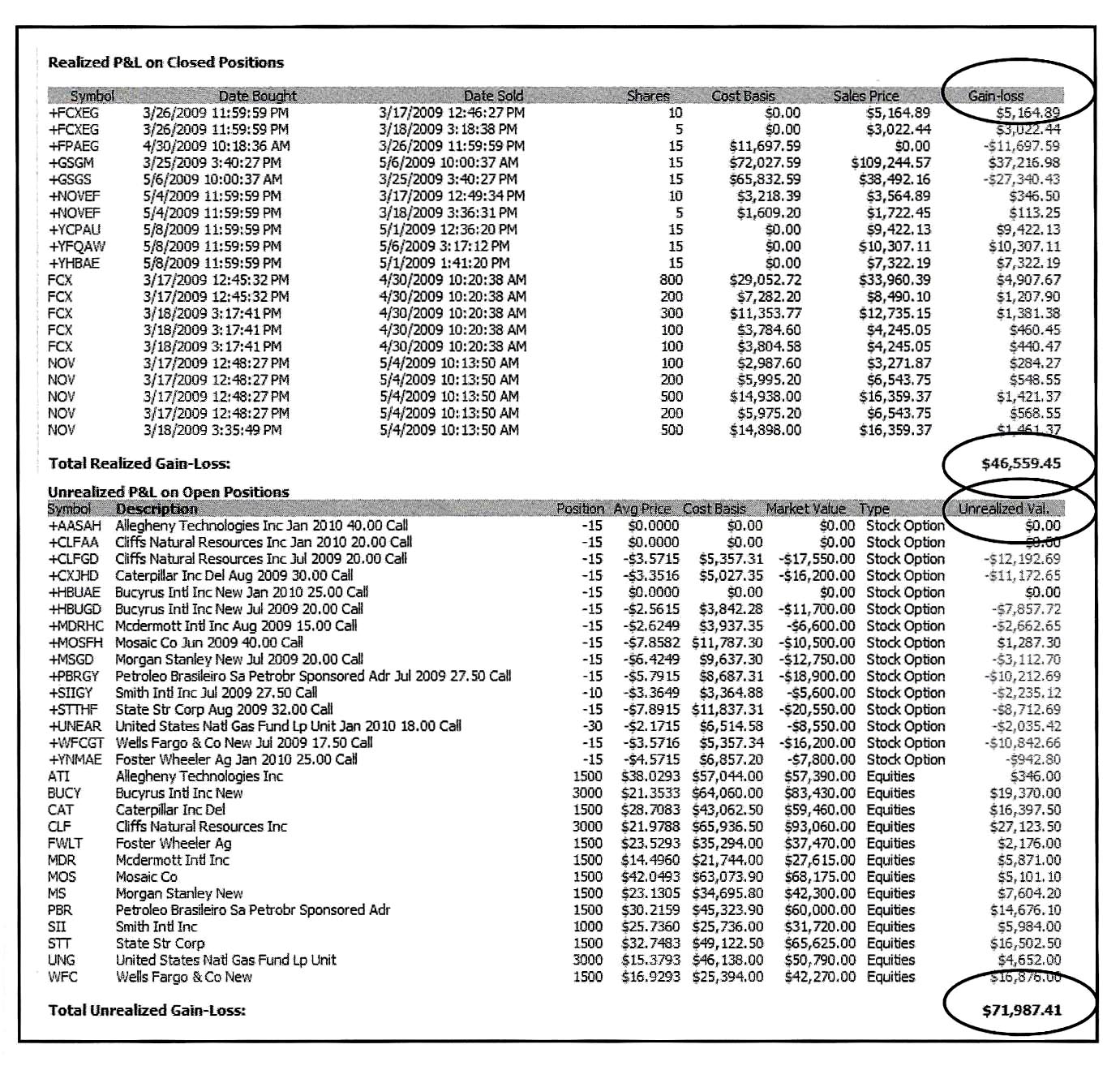

The brokerage account Profit/Loss Report that follows shows my covered call trades for one of my trading accounts. This account was my trading contest account and I started the trading contest with a $311,800 starting balance when I initiated the covered call trades. There was $118,546.86 in net profits after commissions for this portfolio.

I normally reinvest the cash income I receive from covered call trades in additional covered call trades allowing me to compound my trading results. I received a total of $152,900 in cash income for the current trades resulting in an average cash payment of 49% for the portfolio.

This portfolio is widely diversified across different industry groups. All of the trades in this portfolio are currently showing a net profit for the spread demonstrating the ability of the covered call strategy to produce a high percentage of winning trades. Even if the underlying stocks in this portfolio decline moderately I can still realize a good return for the portfolio.

I normally take profits when a covered call trade reaches 90% of its profit potential. This enables me to take profits on trades well before option expiration and initiate new covered call trades allowing me to compound the cash income I receive. (Note: I traded a large number of option contracts in this account. Trading one option contract would require a smaller trading account.)