Stock Price Movement

By: Rob Roy

The following is an excerpt from Rob Roy's Option Axiom Rules Trading Course

The more time there is to expiration, the less sensitive the option is to stock price movement. The less time-to-expiration, the more sensitive the option is to stock price movement. The reason for this goes back to the Greek Gamma. The closer to expiration the option is, the more gamma – rate in change of delta, or sensitivity to price change – the option will have. The farther out in time, the less gamma the option will have. To understand the difference in sensitivity to stock price change, take a look at the graphs below.

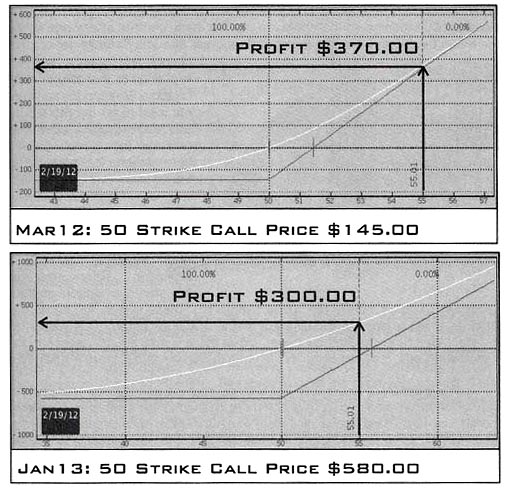

The top graph is the March 2012 expiration 50 strike call that was bought for $1.45 ($145 per contract price). The bottom graph is the January 2013 expiration 50 strike call that was bought for $5.80 ($580 per contract). There are 28 days to expiration for the March contract and 334 days to expiration for the January contract.

The stock price moved from $50 per share to $55 per share. From that $5 move in the stock price the MAR 50 call made $370 of profit, while the JAN 50 call made only $300 of profit. The only difference between the two trades is the time to expiration, and the cost of each trade. The March 2012 options with only 28 days to expiration made a full $70 more than the January 2013. The truth of the two positions comes out when a trader takes a look at the return on the capital. The March 2012 50 strike call made 225% return, while the January 2013 50 strike call only made a 52% return. This difference in return on capital comes from the simple fact that the March expiration option has less time to expiration, therefore less cost as well. The closer to expiration options will react faster to a change in the stock price.

What is true for profiting in a trade is also true for losing on a trade. The nearer to expiration options do make money faster with a stock price in change. That also means they lose money faster if the stock was to move against them.

Take note however, that in a Straddle or a Strangle, the trader can profit from movement up or down. What the Straddle and Strangle trader needs to be aware of is that they want a balance between having enough sensitivity to a move from the stock price, yet also have enough time from expiration that the trade does not suffer too much from time decay. Remember that in these positions the trader is purchasing both a call and a put and both of them will suffer time decay.

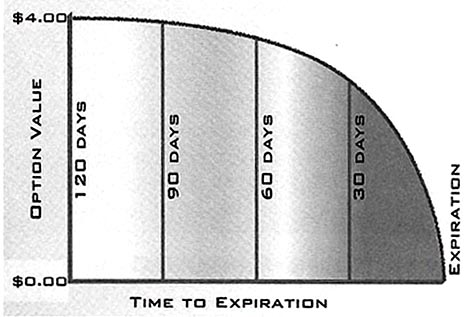

For my Axiom Strangle’s Profit Sweet Spot, the balance between this sensitivity to the move and losing value from time decay falls into a range of about 60-90 days to expiration. However, due to the fact that the option expiration months available may very from the three different option cycles (when the market releases the expiration months so that there are not too many choices at any one time), there can be a time when the trader finds a great Straddle/Strangle set up, but cannot find options with an expiration in that range. The trader does not want to go out more than about 120 days to expiration or closer than about 45 days to expiration, as illustrated below.

There are some secondary events that sway the Straddle/Strangle trader’s decision when selecting the option expiration. There may be an earnings announcement upcoming, product release, corporate event, etc. These events can cause the stock to make a larger than normal move in the stock price. That would be excellent for a Straddle/Strangle trader. While these events are not necessary for a profitable trade, they can certainly help with movement and expiration selection.

For example, if the trader knew there was an earnings announcement happening in two weeks, they might be more inclined to use a closer to expiration month: say 45 – 60 days. However, if there was not a known event happening in the stock, yet the trader found a great Strangle candidate, they may decide to use the expiration month with closer to 90 days, giving the stock time to make the potential move.