Event Trading: When to Buy

By: Peter McKenna

The following is an excerpt from Peter McKenna's The Event-Trading Phenomenon

Here is a hard and fast rule to apply to your trading: Never buy at the open. The market will gap way up at the open then it will fade. This is almost a certainty; it happens more than 85% of the time. If you by at the open, you will pay a higher price for your contracts than if you wait for the price to come down.

Here’s the way the market works on the vast majority of all trading days. From 9:30 am to 9:40 am traders will rush into the market, trying to get their buy orders filled. As a result, the market will gap up. Around 9:40 am, this buying will slow briefly and sellers will overtake the buyers. The gap is being filled. Often, before turning around and going back up, the market will actually fall below the opening price.

The best time to send your option buy order is during the first reversal period. During this time, which usually lasts for about 15 minutes, from 9:40 am to 9:55 am, the price of the options will come down from their opening price. Your goal is to get the lowest possible price.

If you miss the first reversal, a second period of falling prices usually starts at about 10:10 am and lasts until about 10:25 am. The problem is that this reversal will not be as strong as the first reversal. You may not get a price as low as the one available during the first market dip. If you miss the second reversal, sit out the day. Do not chase the market after it has already made a significant gain. After the market has gone up substantially, the potential profit is not worth the risk.

The Bidding Process

When you buy an option, you engage in a bidding process. If you want to buy the Nasdaq 100 1025 call, for example, you would see the following information on your computer screen:

Symbol/Description |

Bid |

Ask |

Last |

High |

Low |

Open |

NDKHA/AUG. 1025 C |

74.50 |

75.50 |

74.80 |

77.20 |

74.00 |

76.50 |

These are the prices you would see during the first reversal period. Notice that the contract opened at $76.50 at 9:30 am when the bell rang. It gapped up to $77.20 during the first 10 minutes of trading. Then it backed down to a low of 74.00. It now has a bid of $74.50 and an ask of $75.50. The “bid” is the price someone is willing to pay for the contract. The “ask” is the price a seller is asking for the contract.

The best strategy is to enter a market order. This means the trade will be executed immediately at the ask price. You will pay $75.50 for the contract. This is likely the lowest price you will get during the whole trading day.

A second strategy would be to enter a bid between the bid and ask, or $73.50. However, this may not be a good strategy if the market is starting to move up again. The price will probably move higher than $73.50 by the time you enter the trade in your computer and hit the send button. This means you will have missed the trade. Now you must start over by modifying your offer to a higher price. While you are doing this, the price will be moving up. Picking the right price will be difficult. You may send in several orders that are not filled. Meanwhile the market will soar and you will be forced to chase it higher, which, as noted above, is a bad strategy.

The best strategy is to wait for the reversal period and then execute a market order. These orders are completed in seconds because you are buying at the ask price. You have dropped out of the bidding process and accepted the highest price. But the price is still lower than it was before the first reversal began.

Yet another strategy is to enter a low bid before the market opens, in hopes of getting that price during the fade. In the example above, when the contract opened at $76.00, you would send in an order below that price, say $74.00. The danger is that there is no way to know how low the price will go during the reversal. Your bid could be too low, which means you will miss the trade and will have to start chasing the market. Entering a market order during the reversal is still the best strategy.

How do you know when the reversal period has ended and prices will go back up? There is no way you can know for sure. It’s a matter of feel and experience. If you spend a few days watching the prices of contracts go up and down, you will get an idea of the size of reversals on fast days, moderate days, and slow days. I generally send in my order if the contract price, during the reversal period, drops $1.00 from the opening price. It’s far better to pay a little more than the lowest price of the day than to miss a good trade.

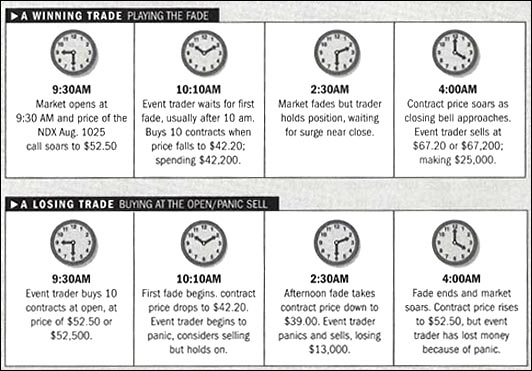

Let’s say you decide to trade NDX options. Here is the way a winning and a losing trade would look.