Let Price Movement Determine When You Buy or Sell

By: Chuck Hughes

The following is an excerpt from Chuck Hughes' Lifetime Income System

Through experience I have learned that you want to purchase a stock only if the buying pressure exceeds selling pressure as indicated by the stock being in an up trend. Buying a stock in a down trend is risky as it requires you to correctly predict when the stock will ‘bottom out’ and resume a price up trend.

Buying a stock because it is cheap and predicting that the price has bottomed out can be nearly impossible to forecast correctly on a regular basis. This ‘crystal ball’ type of approach is risky as you must correctly predict the future price movement. A safer approach would be to wait until a stock is in price up trend before buying. A stock’s price reflects all of the known information about a company so let the price movement of the stock tell you when you should buy and sell.

Similarly, you don’t want to take a short position in a stock unless the stock is in a price down trend. Taking a short position in a stock in a price up trend requires you to correctly predict when a stock will top out and start a price down trend.

Quantitatively Measuring Buying and Selling Pressure

There are many variations of moving averages that can be used to determine the price trend. In my experience, the 1-Month Price of a stock in relation to its 10-Month Simple Moving Average (SMA) is an excellent way to quantitatively identify the price trend of a stock. Identifying the price trend allows us to know in advance the most likely future price movement of a stock.

If the 1-Month Price (shorter-term) is above the 10-Month SMA (longer-term) a bullish price trend is indicated. And if the 1-Month Price is below the 10-Month SMA a bearish price trend is indicated. This simple system has been very effective in correctly identifying bullish and bearish price tends.

The goal of my PowerTrend System is to determine whether a stock is in a price up trend or down trend. This has to be established before you buy a stock or take a short position in a stock. Investing with the trend is a basic principal that is essential for successful investing.

If we can quantify the price movement of a stock we can determine the price trend and the most likely future price movement of a stock. Many times the major price trend continues in the same direction and can persist much longer than you might expect.

For example, the price chart below depicts the monthly price movement and the 10-Month SMA for Mastercard (symbol MA) stock. In the lower left hand corner of the chart we can see that the 10-Month price of Mastercard stock closed above its 10-Month SMA (circled) triggering a ‘buy’ signal for Mastercard.

This buy signal indicated that the most likely future price movement for Mastercard is up and the stock should be bought. Mastercard stock has advanced steadily since the buy signal rewarding investors with more than a 500 point profit since the buy signal was issued.

When the 1-Month price of MA closed above the 10-Month SMA around the 240 price level, it was hard to imagine the stock would rally more than 500 points. This is a good example of why it is better to follow the price trend instead of listening to analysts’ predictions.

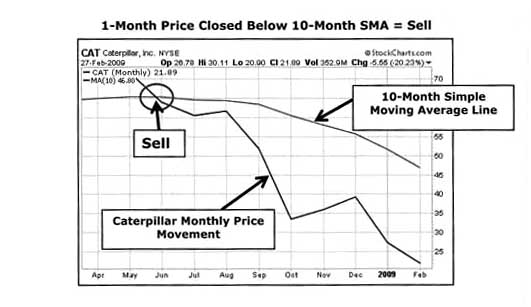

Now let’s take a look at a PowerTrend ‘sell’ signal. The price chart below depicts the monthly price movement and the 10-Month SMA for Caterpillar stock (symbol CAT). In the upper left hand corner of the chart we can see that the 1-Month price of CAT stock closed below its 10-Month SMA (circled) triggering a ‘sell’ signal for Caterpillar.

This sell signal indicated that the most likely future price movement for CAT is down. If you owned CAT stock or call options you should consider selling your stock and calls or purchasing put options to protect your CAT stock and call option profits.

Selling CAT stock when this PowerTrend sell signal was issued would have prevented a painful 66% price decline in the stock.

It’s important to note that the PowerTrend system takes both long and short trades. Short trades profit if the underlying stock or index declines in price. During the last two severe bear markets when the S&P 500 Index lost more than 50% of its value, my subscribers and I actually profited handsomely from taking short positions. Taking short trades can actually diversify and reduce risk in your portfolio.