The Influence of Interest Rates and Unemployment

By: Steve Swanson

The following is an excerpt from Steve Swanson’s Market Turning Point Trading

The Federal Reserve’s job is to keep money flowing in the economy, and to keep inflation under control. But as you’ll see in the up-coming chart, the Fed is usually a little late to the party when making adjustments to the rates.

What comes as a surprise to a lot of people is that one of the biggest inflators in the economy is when there is too much employment. Too many people working causes inflation because with higher earnings comes a higher demand for products, and that demand always leads to higher prices.

That’s why employment numbers are important to watch.

We’ve heard the Fed talk about the 6% target frequently enough over the past few years that we ought to believe it. That is the Fed’s target number for unemployment and what they consider the sweet spot where economic factors are in balance.

When employment figures fall below six percent, employers begin to create incentives which can include bonuses, stock options, and higher pay, to attract the best and brightest employees in their industry. But once more, like a game of dominos, the increased job competition leads to excessive salary inflation.

Inflation becomes a pass-through-cost to the consumer as it pushes prices upward in every industry: higher salaries affect raw commodities prices, manufacturing, transportation, and ultimately finished goods costs. Once established, inflationary pressures can be relentless.

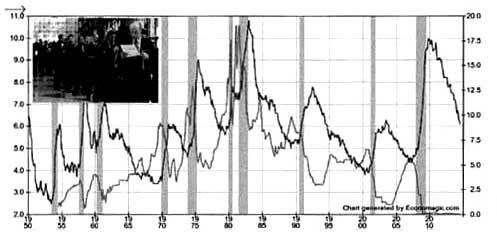

In the chart below we compare the Fed Funds Rate (scaled on the right) to the unemployment rate (scaled on the left) since 1950. Notice how the peaks and valleys on the chart don’t line up: Each time employment falls or trends below 6%, the Fed Funds Rates begin to climb. Sometimes the Fed will even raise rates in “anticipation” of a fast falling unemployment rate fearing that employment will fall below six percent.

When the Fed raises rates, unemployment begins to slow, and will eventually turn upward. In fact, unemployment almost always spikes higher after the Fed has raised rates by two or three percent.

Unfortunately, there never seems to be a middle ground where rates and unemployment finally balance out. It’s a constant teeter-totter. Unemployment has a hair trigger reaction to interest rates, and once it starts to move, it tends to swing to extremes more often than not.

The end result of raising rates and higher unemployment is an economic recession. A recession is determined by an economy that begins to contract instead of expand. Recessions are a time when employees who were feeling pretty secure, suddenly find themselves looking for a job, and stock markets get pummeled. In reaction, the Fed starts dropping rates, usually quickly, in an effort to “stimulate” the economy once more.

Wages and Inflation: Trend Strength

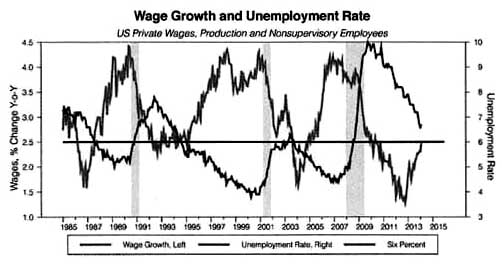

From a slightly different point of view, it’s not just the unemployment rate the Fed is trying to manage; it is also the inflationary costs of wage growth that track it. Take a look at the chart below demonstrating the wage and employment rate and how they impact the economy.

Here we see the year-over-year changes in wages as it pertains to non-supervisory workers. In this case, interest rates climb as soon as wage growth approaches four percent, and unemployment follows. In 2014, wage growth remained low, but has been rising since its bottom in 2013. When unemployment falls below six percent, we should see the wage growth number also begin to quickly accelerate. Look for the Fed to start raising rates soon afterwards.