Stocks: Milestones, Mergers & Splits

By: Chris Verhaegh

The following is an excerpt from Chris Verhaegh's The PULSE System

Stock Milestones

If a stock hits a 52-week high, or better yet, an all-time high, investors start to get a little antsy. While they may not liquidate their entire holding, many of them want to take some profits off the table. As a result, usually within a few days of hitting a record high, the price will fall back a bit. If we’re paying attention, we can capture some of that movement and profit from it.

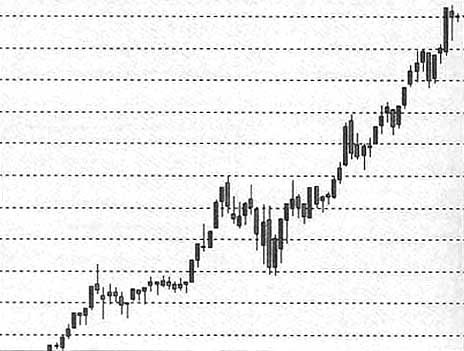

Below is a chart that illustrates what I mean. This is a long-term chart, spanning over six years of price action. Yet throughout the timetable, this stock continues to set new record highs. At almost every new high, however, you can see that the stock experienced a sharp pullback before continuing its upward climb. The interesting thing is most of these peaks and pullbacks occur on the dotted lines on this chart. Each of these dotted lines represents a “round figure” price. I’ve removed the dollar figures from this chart so that you wouldn’t get distracted by them. The fact is they could be $1, $5, $10, $50 it doesn’t matter. The key factor is the market reacts to benchmarks. “Oh my gosh, the stock hit $10! Sell, sell!” “Oh my gosh, the stock hit $100! Sell, sell!” “Oh my gosh, the stock hit $500! Sell, sell!”

That’s quite a few opportunities for traders like us! I don’t believe there was anything significant about the points where the price reversed. I believe it was jut the psychological impact of seeing the stock hit a new round dollar figure. I can just hear the investors, “We’re at $10! We’ve never been in the double-digit territory before! That’s too high! Sell, sell!” Once the investor frenzy starts, that’s our cue to pay attention for possible opportunities to make some profit for ourselves.

Record lows work the same way, only in reverse. When a stock makes a new bottom, even the most negative short-sellers begin to wonder if the time is right to pick the stock up at a discount. Consequently, as the stock continues to sink, bargain-seekers will make it “bounce” up again and again off those lows, creating more trading opportunities for us!

Mergers and Acquisitions

These are a little harder to predict, because companies usually keep this kind of information hush-hush until they are ready to announce. This is understandable. They don’t want another company or investor muscling in on their deal. Occasionally, though, we hear rumors about buyouts that make us take note of a particular stock, either the acquirer or the acquired, or both.

Depending on analyst sentiment, the stock could move dramatically up or down. If the analysts believe the merger is a good thing, either or both of the companies’ stocks will gap higher. If they believe it’s a potentially bad move, one or both could gap lower. Sometimes, you’ll even see one party’s stock gap up while the other gaps down. It all depends on what the pundits predict.

The real game-changer is when a Merger or Acquisition doesn’t get regulatory approval. This is almost always a surprise to the analysts. We have seen this frequently in the airline industry.

Stock Splits

When a stock performs a normal split, it’s typically because the stock price has gone so high, the Board of Directors want to make the shares “affordable” again for the typical investors. They do this by issuing a special dividend; a non-taxable dividend where they pay in shares as opposed to cash.

Let me share my personal story of a stock I’ve had split on me many times to help explain the concept of a normal split and then I will tell the horror story of the reverse split.

I bought Harley Davidson stock back in the 1980’s when it had its Initial Public Offering (IPO) at $8 per share. At the time, the Japanese motorcycle manufacturers were close to putting Harley out of business. I bought the stock more as an enthusiast than as an investor.

President Reagan saved Harley by imposing a tariff on imported motorcycles with an engine displacement above 750cc. Harley stock took off. It made its way to $40 a share and the board decided to issue more shares and give every shareholder an additional share for each share they owned. I then owned twice as many. So did every other Harley shareholder. The total value of the company didn’t change, just the number of shares and their price. The number of shares doubled as the price was cut in half. Since I paid $8 for them initially, now that my quantity doubled, my net cost was cut in half to $4 each.

Harley stock continued higher. It made its way back towards $40. The Board declared another split. I now had four times as many shares as I started with. My taxable cost basis had now dropped to $2.

Harley stock continued higher. It made its way back towards $40. The Board declared another split. I now had eight times as many shares as I started with. My taxable cost basis had now dropped to $1.

Harley stock continued higher. It made its way back towards $40. The Board declared another split. I now had sixteen times as many shares as I started with. My taxable cost basis had now dropped to 50 cents.

Harley stock continued higher. It made its way back towards $40. The Board declared another split. I now had thirty two times as many shares as I started with. Shares for which I originally had paid $8 each now had a taxable cost basis of 25 cents.

Reverse splits on the other hand, usually are not a good thing. They are exactly the opposite of a stock split – a stock has fallen so low, the company needs to keep the price up by reducing the number of shares. When I hear of a reverse stock split, I want to tell people to run away as fast as they can. In a reverse split, you turn in more old shares for less new shares. Instead of the price dropping, it rises. I say run because when the stock price becomes higher due to the split, it usually doesn’t remove the problems that caused the reverse split in the first place. Reverse split stocks are poison! Unless it’s on an ETN multiplier. Reverse Splits may be kryptonite to Superman, but in the right situation, I’m Lex Luthor!