Turning unusual activity in options into trading profits

By: Jon Najarian

If you have seen me on television or read quotes from me in the press,

you may remember that one of the primary catalysts that I use for placing

short-term and long-term trades is unusual activity in the calls or puts

of a given stock. My reasoning is tied to an old Wall Street adage that

fear and greed are what move the markets. I focus on the greed side, as

I believe individuals who have information they deem market-moving will

all too frequently tip me off to their intentions by accumulating calls

or puts in unusual volumes.

'Unusual' could mean volume is significantly greater than previous sessions.

It could be the ratio of calls to puts. It could be the dollar-weighted

ratio of puts to calls. Something strange is calling my attention to a

certain class.

History has shown me that institutional investors, be they hedge funds,

mutual funds or just very large speculators, will enter orders to buy

or sell call or put options in big size. They use options for both the

leverage (virtually every option represents the right to buy or sell or

to take on the obligation to either buy or sell 100 shares of stock) and

the anonymity of options.

The catalyst for these trades is that these entities think they know something

you don't! They could be hedging, but more frequently they are positioning

themselves ahead of some sort of announcement or news event.

Without getting into my formulas and algorithms, this is basically what

this unusual activity is telling me:

- If they are buying calls, history tells me they anticipate something bullish coming out.

- If they are buying puts, they may think an investigation, profit warning or other bad news is pending.

The choice of expiration also

tells me how 'fast' the information is likely to hit. A near-term accumulation

of call options could signal a takeover while the large purchase of 3-month-out

calls tells me the information may take longer to play out. Either way,

the unusual activity in the options pits is like that puddle of water

in Jurassic Park that shook when the T-Rex started to return. Options

accumulation clues me in to where the big animals are feeding!

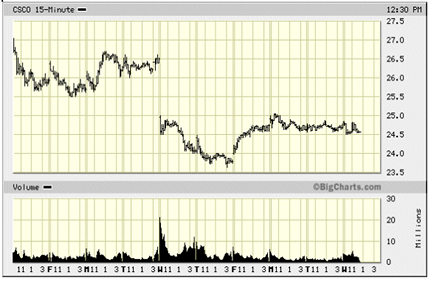

Here is an example of what I saw and reported on February 3, 2004, about

unusual activity and how I think an investor can use this valuable information:

'Smart Money Expects CSCO to Move Small - Ahead of Cisco's (CSCO) earnings

tonight, there has been little bullish speculation on the out-of-the-money

calls, with most of the attention focusing on the Feb 25 calls, which

are up $.05 to $1.80 on 24,000 contracts while the Feb 27.5 calls are

withering on the vine, losing 17% to $.50 on a huge 82,000 contracts.'

Okay, so how would I use that information? Well, since the sellers were

hammering on the February 27.5 calls, I translated that into the idea

that smart money was betting CSCO wouldn't be beating the Street's earnings

estimates and or the so-called whisper number. This wasn't as bearish

as a put purchase would have been but was certainly an indication that

the sellers expected CSCO not to climb back up to $27.5!

As the chart above shows, the sellers of those 82,000+ February 27.5 calls

were licking their chops when the earnings came out, as CSCO fell to $24.5

very quickly, making those $.50 calls worthless and generating a fast

$4.1 million for those sellers!

The bottom line

is that unusual options activity almost always tells me where the market

is going. Knowing where the institutional paper is buying or selling can

substantially increase your returns once you know how to interpret it!

Futures

trading involves high-risk with the potential for substantial losses.