The Momentum Play

By: George Angell

The following is an excerpt from George Angell's Small Stocks, Big Profits

This strategy is not for the faint of heart – but, the truth is, this is what often wins the game. This is an aggressive strategy that requires the investor to spend a lot of time on the sidelines waiting to strike when the iron is hot. Too often you will find that you are fully invested in stock A when the real opportunity exists in stock B. Your problem: your money is all tied up in stock A. So if you want to be properly prepared, keep your powder dry.

There are two keys to capturing a powerful momentum play: price and volume. Since most moves are good for at least three days (remember the rule of three applies to a number of situations in the market), you must be willing to move quickly. A larger percentage gain is typically the first sign of a good momentum play. Moreover, this will often manifest itself as a breakout. This, by the way, is why this strategy is so difficult to implement. Do you really want to be a buyer of a stock at a new high? A lot of investors find this psychologically hard to do. Second, you want high volume, far in excess of normal volume. The price percentage move and volume reading are relatively easy to identify. The hard part is pulling the trigger.

One way to capitalize on this strategy is to be prepared to take the position before a signal is given. You might track a given stock in anticipation of the momentum signal. Once the stock is in play, you must then, without hesitation, jump aboard the move. The time to spot a momentum trade is when the stock is coming down and the rate of descent begins to slow. At first, the price will begin to consolidate; this is the phase where the momentum is clearly changing from down to up. Next, the stock will experience accumulation by those investors in search of an undervalued opportunity. Within the consolidation, look for a saucer pattern to form as prices begin to move sideways above the support. At this stage, the stock is poised to breakout and move up on higher volume.

Ironically, a classic sign of a stock getting ready to move significantly higher is when prices drop to new lows. This is the point where all hope for higher prices is lost. The last sell-stop has been hit and the selling palpable. Here you want to track the stock’s behavior carefully. If indeed all hope is lost, you should have even lower prices. You may have just registered a low in the stock’s price. But if there is a quick move up, with the stock perhaps closing at the top of its day’s range, you have a classic reversal trade – a truly strong reversal that will attract momentum players. The point here is: a move that doesn’t behave as anticipated signals a reversal.

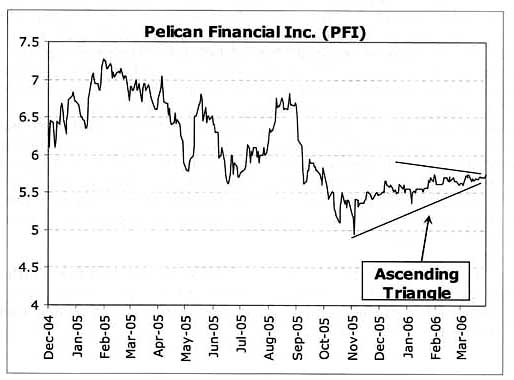

For example, in the case of Pelican Financial, Inc (PFI), as shown on the chart below, the stock made a sustained move from the 52-weeks highs at $7.40 all the way down to the $5 area – which proved to be the bottom of the move. After bottoming out, Pelican Financial made a clear-cut ascending triangle pattern on the chart. As it neared the apex of the triangle, momentum players lined up to jump on the stock as it powered higher. It is important that you identify these trades before they occur. Once the breakout occurs, the run to higher prices should occur quickly.

The key to identifying this trade is the failure of the stock to fall below its prior 52-week low of $4.75 a share. The fact that the stock made a new low on the move (breaking the prior support) without follow-through on the move was the key to the reversal. Next, the consolidation within the ascending triangle was the sign that the stock was getting ready to move substantially higher.