Six Reasons to Love MLPs

By: Chuck Hughes

The following is an excerpt from Chuck Hughes' Ultra-Safe Money Strategies

Master Limited Partnerships (MLPs) are similar to Real Estate Investment Trusts (REITs), as they do not pay income taxes. MLP shares trade on the major stock exchanges, and they provide investors with attractive yields due to their special tax treatment. They are an income investor’s dream come true.

MLPs, however, are different in structure than REITs. Whereas REITs are a special type of corporation, MLPs are partnerships. A general partner is responsible for running the MLP partnership and individual investors are the limited partners.

By law MLPs pay their profits directly to their shareholders also called unit holders. MLPs pay much bigger dividends than other dividend paying stocks because they pay no tax and pay out their profits directly to their unit holders. A MLP’s income is allocated among all partners in proportion to their ownership interest.

There is also a special tax benefit with MLP dividends which are called distributions. The IRS generally considers 80% to 90% of MLP distributions a return of capital which means investors can defer taxes on their gains for years and years until they sell their units. MLPs originated with the Revenue Act of 1987 as a tax-advantaged way to encourage energy exploration in the Gulf of Mexico.

Due to the favorable tax treatment of MLPs they have attracted companies in a variety of industries including oil and gas exploration, coal, energy pipelines, timber, fertilizers and real estate. These MLP companies are able to sidestep the IRS and pass their earnings directly to their investors.

MLPs are relatively unknown compared to mainstream dividend paying stocks. MLPs have a low level of institutional ownership and Wall Street’s analysts largely ignore this industry.

Oh yes, I do love MLPs and so should you! I can come up with six more good reasons why these gems should be part of your portfolio!

- Payouts – Yes, past years have taught many investors that there are very few things that you can actually count on. MLPs have payouts you can count on! If for no other reason you explore them, this should be it. Let me explain a little more about their system. Distribution cuts would hurt a partnership’s unit price. Because of this, management is extremely careful with its cash. They normally keep a safe reserve of cash on hand in case it is needed for distributions.

- Managers Who Know How to Manage – Management is normally very careful and disciplined. They have to pay big distributions out of their earnings every quarter. Because of that you will not find the showy and wasteful ego driven projects, the kind that have been the down fall of corporate America in the past.

- Stable Earnings for Stable Profits – MLPs are fueled by strong demographic trends. They offer far more predictable earnings than the broad market. Their volatility is less than that of the S&P 500 Index primarily due to having stable sales volumes.

- Bear Resistant – Well nothing is entirely fool proof but this one ranks up there. Unless your managers are truly incompetent you should keep getting those nice, big, quarterly distribution checks in your brokerage account. Since MLPs are generally not correlated with the stock indexes you need not follow the chaos, unless you wish to.

- Risk Reducer – Since MLPs are generally not correlated with the stock indexes and have very little correlation with bonds, adding MLPs to your portfolio will help with its diversification. You can cut risk while increasing your returns. It sounds like a win-win to me!

- You’ve Got a Friend with MLPs – That friend would be the regulators. Positive federal oversight promotes good management. Management is able to be creative and cut costs at the same time. These savings are passed on directly to the shareholders.

There are lots of good reasons to make MLPs part of your portfolio. Let’s next take a look at three examples of the returns generated by MLPs compared to the S&P 500 Index so you can get an idea of the powerful return potential of MLPs.

The return graphs that follow depict the return performance for a sampling of MLPs in different industries versus the S&P 500 Index over a ten year period.

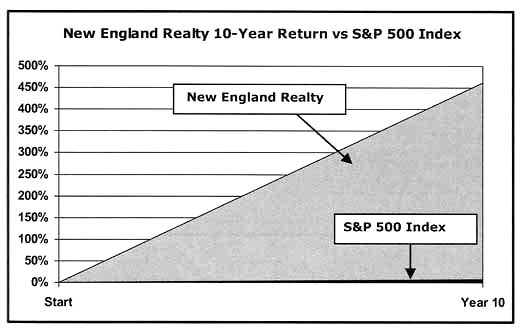

The first graph depicts the return performance for New England Realty Associates versus the S&P 500 Index. New England Realty is a microcap property management MLP with a total market cap of $9 million.

MLP |

10-Yr Return |

New England Realty |

462% |

S&P 500 Index |

9% |

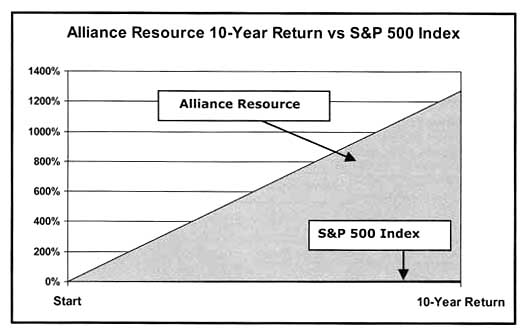

The second return graph depicts the return performance for Alliance Resource Partners LP versus the S&P 500 Index. Alliance Resource Partners is a coal marketing and production MLP.

MLP |

10-Yr Return |

Alliance Resource |

1,274% |

S&P 500 Index |

9% |

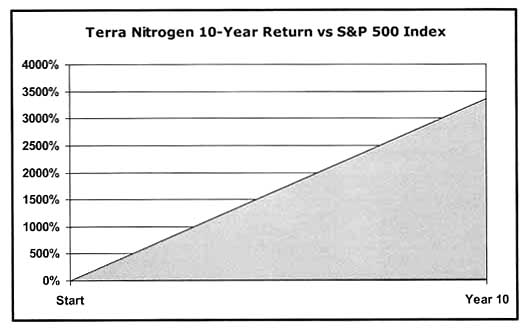

The last graph depicts the return of performance for Terra Nitrogen LP versus the S&P 500 Index. Terra Nitrogen produces fertilizers, and at the time was paying a 14.6% dividend yield.

MLP |

10-Yr Return |

Terra Nitrogen |

3,355% |

S&P 500 Index |

9% |